Small business inventory and accounting software – In the realm of small business management, inventory and accounting software have emerged as indispensable tools, empowering entrepreneurs to optimize operations, enhance efficiency, and propel growth. Join us as we delve into the intricacies of these solutions, exploring their key features, benefits, and best practices.

Effective inventory management ensures accurate stock levels, reduces waste, and optimizes cash flow. Accounting software, on the other hand, streamlines financial processes, simplifies tax compliance, and provides valuable insights into business performance. By integrating these two essential functions, small businesses can achieve unparalleled operational efficiency, freeing up valuable time and resources to focus on strategic initiatives.

Small Business Inventory Management

Inventory management is essential for small businesses to optimize operations, reduce costs, and enhance customer satisfaction. Effective inventory management ensures that businesses have the right products, in the right quantities, at the right time to meet customer demand.

Choosing the Right Inventory Management Software

Selecting the right inventory management software is crucial for small businesses. Consider the following factors:

- Business size and industry: Choose software that aligns with your business size and industry-specific requirements.

- Features and functionality: Determine the essential features, such as inventory tracking, barcode scanning, and reporting.

- Integration capabilities: Ensure the software integrates seamlessly with other business systems, such as accounting and e-commerce.

- Cost and support: Consider the software’s cost and the level of support provided by the vendor.

- User-friendliness: Choose software that is easy to use and navigate, even for non-technical staff.

Benefits of Using Inventory Management Software, Small business inventory and accounting software

Implementing inventory management software offers numerous benefits for small businesses:

- Improved accuracy: Software automates inventory tracking, reducing errors and discrepancies.

- Enhanced efficiency: Automated processes streamline inventory management, freeing up time for other tasks.

- Reduced costs: Accurate inventory tracking helps prevent overstocking and spoilage, minimizing inventory costs.

- Increased sales: Having the right products in stock at the right time boosts sales and customer satisfaction.

- Better decision-making: Real-time inventory data provides insights for informed decision-making on purchasing, production, and marketing.

Small Business Accounting Software

Small business accounting software can help you track your income and expenses, manage your accounts receivable and payable, and generate financial reports. Choosing the right accounting software for your small business can be a daunting task, but it’s important to take the time to find one that meets your specific needs.

Key Features to Look For

When choosing small business accounting software, there are a few key features to look for:

- Ease of use: The software should be easy to use, even if you’re not an accountant.

- Affordability: The software should be affordable for your small business budget.

- Scalability: The software should be able to grow with your business as it expands.

- Integration: The software should integrate with other business applications, such as your CRM and e-commerce platform.

- Support: The software should come with good customer support in case you need help.

Types of Accounting Software

There are two main types of accounting software: desktop and cloud-based.

- Desktop accounting software is installed on your computer. It’s typically more affordable than cloud-based software, but it can be more difficult to use and maintain.

- Cloud-based accounting software is hosted online. It’s typically more expensive than desktop software, but it’s easier to use and maintain. It also allows you to access your accounting data from anywhere with an internet connection.

Benefits of Accounting Software

Accounting software can help small businesses save time and money in a number of ways:

- Automates tasks: Accounting software can automate tasks such as invoicing, expense tracking, and financial reporting. This can free up your time to focus on other aspects of your business.

- Improves accuracy: Accounting software can help you improve the accuracy of your financial records. This can help you avoid costly errors.

- Provides insights: Accounting software can provide you with insights into your business’s financial performance. This information can help you make better decisions about your business.

Integration of Inventory and Accounting Software: Small Business Inventory And Accounting Software

Integrating inventory and accounting software provides numerous advantages for small businesses. By connecting these systems, businesses can streamline their operations, improve accuracy, and gain valuable insights into their financial performance.

Benefits of Integrated Software

- Reduced data entry errors: Automated data transfer between systems eliminates the need for manual data entry, reducing the risk of errors and saving time.

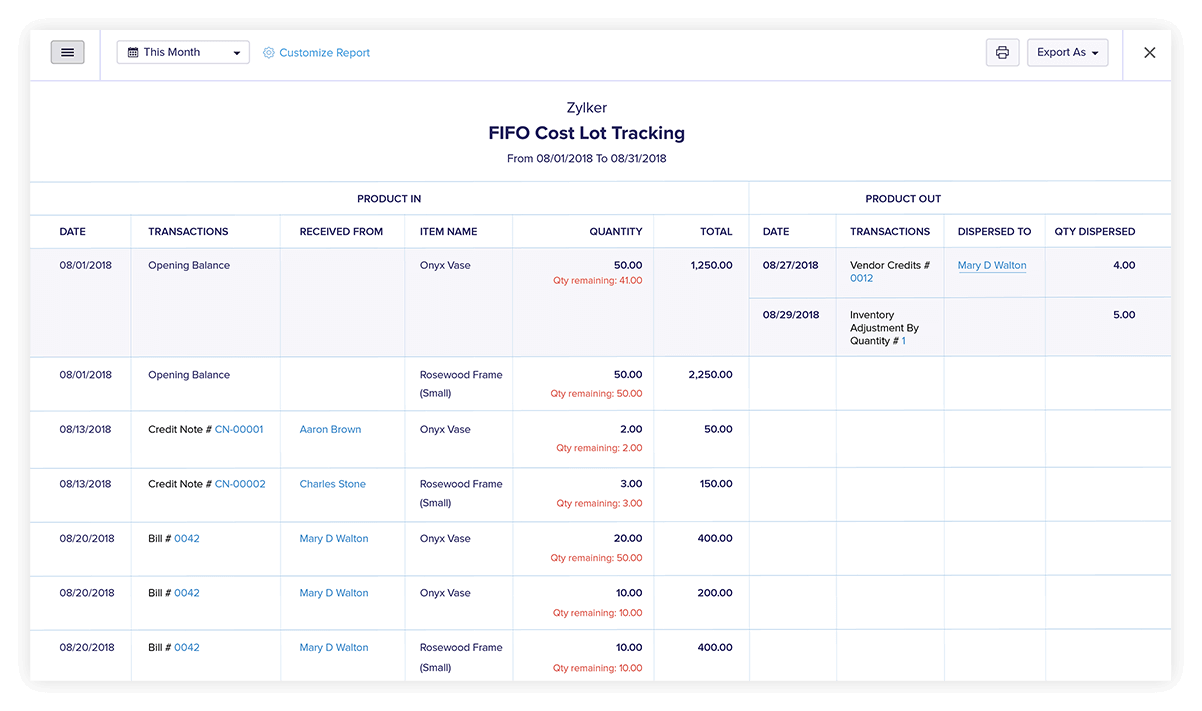

- Improved inventory management: Real-time inventory tracking allows businesses to monitor stock levels, optimize purchasing, and prevent overstocking or stockouts.

- Enhanced financial reporting: Integrated software provides a consolidated view of financial data, making it easier to generate accurate financial statements and reports.

- Streamlined billing and invoicing: Automated billing and invoicing processes based on inventory data improve efficiency and reduce the risk of errors.

Choosing the Right Solution

When selecting integrated inventory and accounting software, small businesses should consider the following factors:

- Business size and industry: Choose software that is tailored to the specific needs of your business.

- Scalability: Ensure the software can grow with your business as it expands.

- User-friendliness: Opt for software that is easy to use and navigate, even for non-technical users.

- Cost: Consider the upfront cost of the software as well as ongoing subscription fees.

Case Studies and Examples

Numerous small businesses have experienced remarkable success by implementing inventory and accounting software. These tools have proven invaluable in enhancing efficiency, optimizing operations, and boosting profitability.

One notable example is a small retail store that struggled with manual inventory tracking and accounting processes. After adopting an inventory and accounting software solution, the store witnessed a significant improvement in inventory accuracy, reduced shrinkage, and streamlined accounting tasks. This resulted in cost savings, improved customer satisfaction, and increased sales.

Benefits of Inventory and Accounting Software

- Enhanced inventory management and tracking

- Automated accounting processes

- Improved financial reporting and analysis

- Reduced errors and increased accuracy

- Time savings and increased efficiency

- Better decision-making based on real-time data

Best Practices for Small Business Inventory and Accounting

Managing inventory and accounting effectively is crucial for the success of any small business. By implementing best practices, small businesses can streamline their operations, reduce costs, and improve profitability. Here are some key best practices to consider:

Effective Use of Inventory and Accounting Software

- Choose software that meets the specific needs of your business.

- Set up the software correctly and train staff on its use.

- Use the software to track inventory levels, manage orders, and generate reports.

- Integrate inventory and accounting software to automate tasks and improve efficiency.

Inventory Management Best Practices

- Establish clear inventory policies and procedures.

- Use inventory management techniques such as ABC analysis and just-in-time (JIT) inventory.

- Conduct regular inventory audits to ensure accuracy.

- Monitor inventory levels and reorder when necessary.

Accounting Best Practices

- Maintain accurate and up-to-date financial records.

- Use a chart of accounts that is specific to your business.

- Reconcile bank statements regularly.

- Prepare financial statements on a regular basis.

Avoiding Common Pitfalls

- Not tracking inventory levels accurately.

- Not using inventory management software effectively.

- Not reconciling bank statements regularly.

- Not preparing financial statements on a regular basis.

Maximizing the Benefits of Inventory and Accounting Software

- Use the software to generate reports that help you make informed decisions.

- Use the software to automate tasks and save time.

- Use the software to improve customer service.

- Use the software to gain insights into your business performance.

Conclusion

Embracing small business inventory and accounting software is a transformative step towards operational excellence. These tools empower entrepreneurs to gain real-time visibility into their business, make informed decisions, and drive growth. As technology continues to evolve, we can expect even more innovative solutions to emerge, further enhancing the efficiency and profitability of small businesses.

Common Queries

What are the key benefits of using small business inventory and accounting software?

Improved inventory accuracy, reduced waste, streamlined financial processes, enhanced tax compliance, and valuable business insights.

How can small businesses choose the right inventory and accounting software solution?

Consider factors such as business size, industry, budget, and specific needs. Seek recommendations, read reviews, and schedule demos to evaluate different options.

What are the common pitfalls to avoid when using inventory and accounting software?

Inaccurate data entry, lack of regular software updates, and failure to integrate with other business systems.